Cyber Crime police busted Fake call center in Mohali, Punjab and arrested gang of (7) members, (4) of them being natives of Hyderabad for Cheating Foreign customers under the pretence of providing technical services.

Facts of the case:

Facts of the case are that, received complaint from Sri. Abdul Nayeem Authorized signatory of HDFC Bank Credit Intelligence and control unit, Hyderabad In which he stated that during transaction monitoring by their bank on all swiping machines they noticed that multiple suspicious transactions happened on the swiping machine (terminal Identification number: 28131948) issued by HDFC bank to merchant Healthy Dental Clinic Transactions were done through 85 different international cards of Debit of Rs.64,40,000/- his HDFC bank within a short span of time i.e., from 18th December, 2021 to 23rd December, 2021. They also suspected that these transactions were carried out using cloned credit cards. They enquired with the merchant i.e., Healthy Dental Clinic, the person failed to provide any proper information related to these transactions and cardholders. Hence they requested authority to investigate and take appropriate action against them.

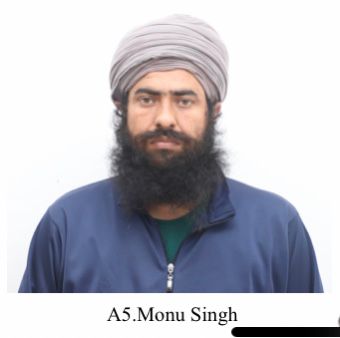

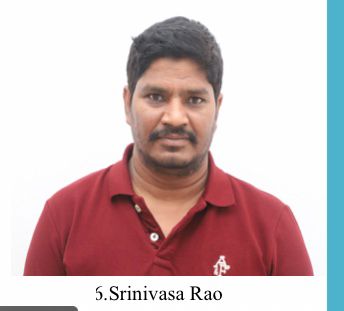

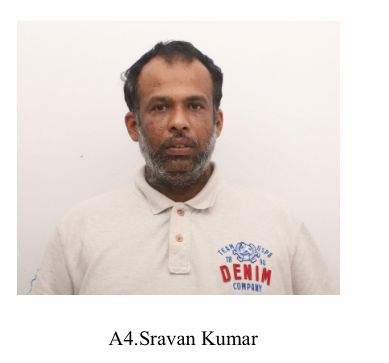

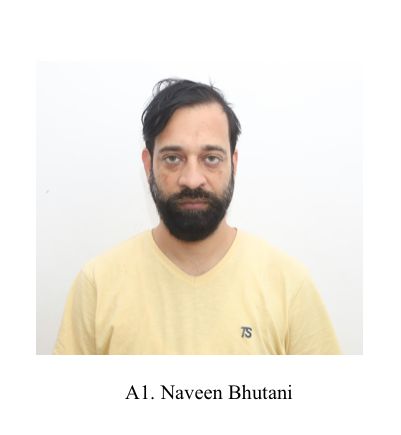

Accused Details:

| A-1 | Naveen Bhutani, S/o. Age: 41 yrs, R/o New Delhi. |

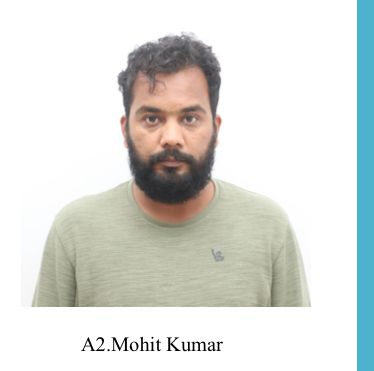

| A-2 | Mohit, Age: 32 yrs, R/o. New Delhi. |

| A-3 | Nagaraju Bondada, Age: 36 yrs, R/o. Hyderabad. |

| A-4 | Donthula Sravan Kumar, Age: 42yrs, R/o. Hyderabad. |

| A-5 | Monu, Age: 33 yrs, R/o. New Delhi. |

| A-6 | Sadhanala Mukkanti Srinivasa Rao, Age: 36 yrs, R/o. Hyderabad. |

| A-7 | Pavan Vennelakanti, Age: 34 yrs, R/o. Hyderabad. |

Modus Operandi:

Naveen Bhutani (A-1) has a considerable experience in working with IT companies providing technical service to foreign customers. In 2017 he registered “RNTECH Services Pvt Ltd” company. Further Naveen Bhutani (A-1) with the assistance of Monu (A-5) established three call centers at various places like Janakpuri of New Delhi, Kaushambi of Ghaziabad and Mohali of Punjab by cheating customers under the guise of providing technical services. Naveen Bhutani (A-1) runs Google ad campaigns with his contact numbers in Australia, UK and Singapore for his companies providing technical services.

They cheat customers in three ways i.e., during inbound calls generated through Google Adwords, Naveen Bhutani (A-1) run Google AD campaigns (for resolving problems related to PayPal, Amazon and Technical devices like router, Internet) with Toll Free Numbers (taken from Real PBX, Vonage and Vibtree), when customers respond to Google Ads and contact, telecallers attend the calls and explain about their services and take remote access of their devices to resolve the issue. In fact no services were given to the customers, but they collect payments through payment gateway links provided by Mohit (A-2).

Mohit (A-2) collect payment gateways from Nagaraju (A-3) & Srinivas (A-4) offering them 50% commission. On the instructions of Srinivas (A-4), Nagaraju (A-3) developed websites and integrated them with payment gateways. Nagaraju (A-3) links the bank accounts of Srinivas Rao (A-6), Pavan Vennelakanti (A-7) and others. Nagaraju (A-3) collect cheated amount through bank accounts linked with payment gateways and forward them to Mohit (A-2) after deducting his commission and taxes.

In second case also they receive inbound calls generated through Email or SMS blasting about any of their recent purchases. Customer responds to their phishing mails or SMS and end up making transactions from their account. During remote access, they also capture the card credentials, using which they can make transactions later as OTPs or PINs are not required for International transactions.

In case of out bound calls, Naveen Bhutani (A-1) and his associates prepare customers mobile number data base belongs to Australia, UK and Singapore. After that telecallers search and identify the customers registered with various e-commerce sites like Amazon. Later they try to login to the various sites (www.amazon.com.au, www.amazon.co.uk, www.amazon.sg) account using the customer data, which triggers an OTP to the customer, then telecallers contact the customer introducing as tech services and collect OTP, further login to the Amazon and other accounts using the OTP and look for transaction history.

On call with customers tele-callers reveal their transaction history and deceive them saying as their email accounts are compromised, they were able to fetch their transactions history and suggest them to take their company services to protect accounts from being compromised. In order to provide services they convince the customers to make a payment and collects payment, they also collect customers card credentials like Card number, Expiry and CVV for further use. They make payments during night hours of the respective countries from where the customer belongs, so that customers cannot block Card or report fraud

In this way Naveen Bhutani (A-1) and tele callers collect payments from customers under the guise of tech services, in fact no such services were given to the customers. So far they cheated the banking institutions and foreign customers to the tune of Rs 25 crores.

Apprehension:

- From the internal investigation of the HDFC Bank, it is learnt that 85 unauthorised transactions were noticed at merchant TID through SMS pay option amounting to Rs 64.40 lakhs. Further investigation revealed that SMS pay links were delivered to the mobile numbers of Nagaraju (A-3) and amount got credited to Pavan Vennelakanti (A-7) HDFC Account. On that Nagaraju (A-3) & Pavan Vennelakanti (A-7) were apprehended.

- Nagaraju (A-3) revealed that he along with Dontula Shravan (A-4) providing Payment gateway links to Mohit (A-2), Nagaraju (A-3) register companies and develop websites with company names.

- He integrated such websites with payment gateways and linked them to bank accounts opened on his name and also Srinivasa Rao (A-6) & Pavan Vennelakanti (A-7).

- On credible information, apprehended Dontula Shravan (A-4) and learnt from him that Mohit (A-2) collects these payment gateways and offer 50% commission on the transacted amount.

- On analysing the bank statements, it is evident that Mohit (A-2) and Naveen Bhutani (A-1) are operating from Delhi.

- Deputed a team to Delhi and apprehended Mohit (A-2), he revealed that Monu(A-5) manages the call center of Naveen Bhutani (A-1). On that apprehended Monu (A-5) and Naveen Bhutani (A-1) and also searched the call center located at Mohali, Punjab.

Seizure:

- Net Cash Rs.1,11,40,000/-

- KIA Seltos Four-Wheeler Vehicle (1)

- Mitsubishi Pajero Four-Wheeler Vehicle (1)

- Mahindra Bolero vehicle (1)

- Laptops (04)

- Mobile Phones (12)

- CPU (10)

- Rubber Stamps (6)

- Cheque books (16)

- Debit Cards (18)

Advisory to Bankers and Payment gateways:

- Bankers should obtain proper KYC documents and must held physical verification of Account holders.

- Payment Gateways need to do proper KYC verification while providing domestic and international transactions.

- Banks & Payment Gateways should be aware and need to verify the accounts if unusual/voluminous transactions held.

Commissioner of Police,

Cyberabad.

You must be logged in to post a comment Login